Pre tax 401k calculator

Pre-Tax Savings Calculator Enter your information below Tax Year 2022 Filing Status Annual Gross Income prior to any deductions Itemized Deductions If 0 IRS standard deduction. Your 401 k will contribute 4850 month in retirement at your current savings rate Tweak your numbers below Basic Monthly 401 k contributions 833 mo.

The Tax Trick That Could Get An Extra 56 000 Into Your Roth Ira Every Year

Your expected annual pay increases if any.

. For example if your household taxable income is 500000 youre in the 35 marginal tax bracket¹ If you retire in 2022 and have taxable income of 340000 from pre-tax. This calculator should not be used as a basis for decision making and is presented only to further illustrate educational concepts about pre-tax contributions vs. 10 Best Companies to Rollover Your 401K into a Gold IRA.

Federal 401k Calculator or Select a state This federal 401k calculator helps you plan for the future. To get the most out of this 401k calculator we recommend that you input data that reflects your retirement goals and current financial situation. Ad Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity.

If you are age 50 or over. A 401 k contribution can be an effective retirement tool. Ad Try Personal Capitals Free Retirement Planner.

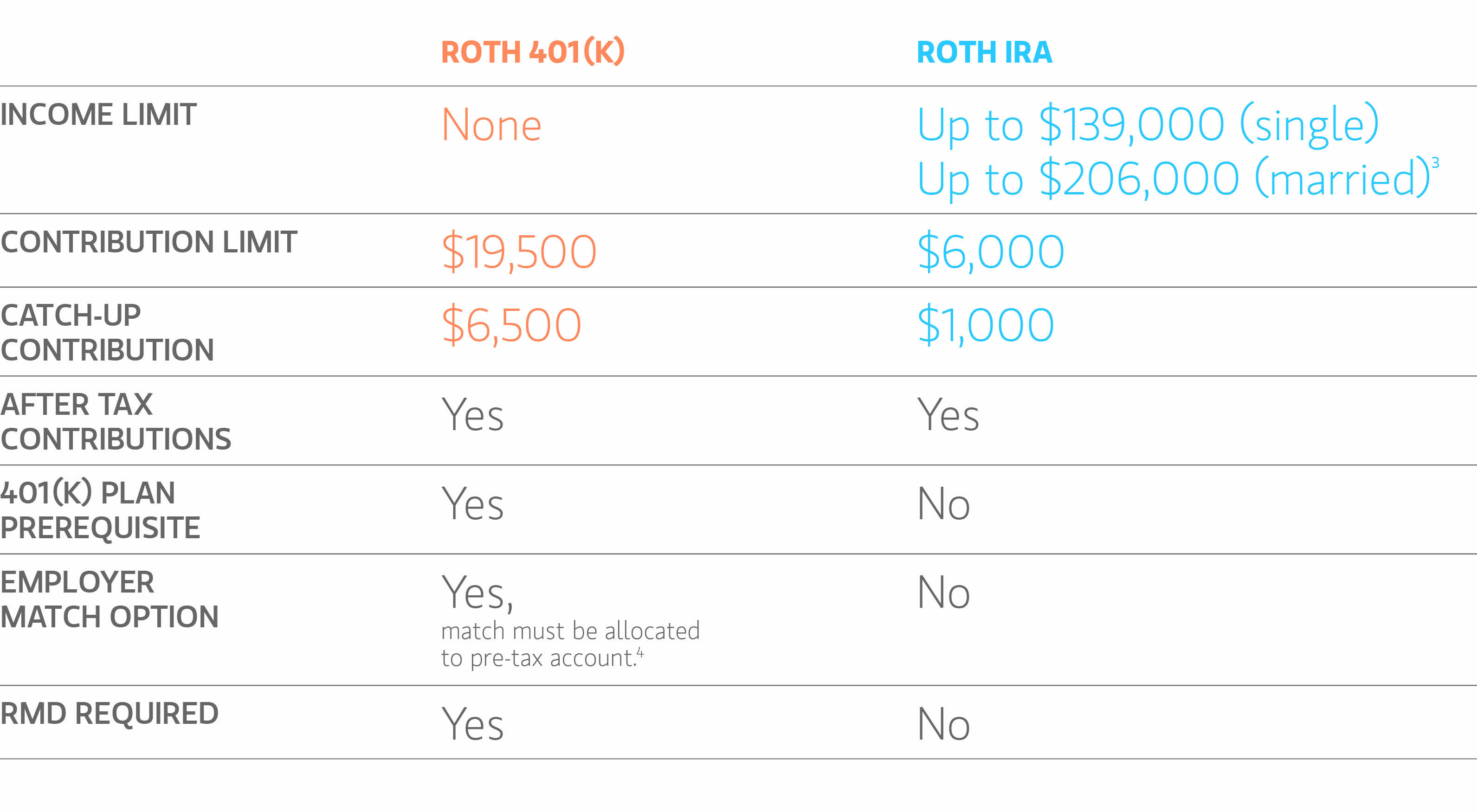

The annual maximum for 2022 is 20500. Retirement Calculators and tools. Ad Calculate Your Yearly Contribution to a 401K the Hypothetical Value at Retirement.

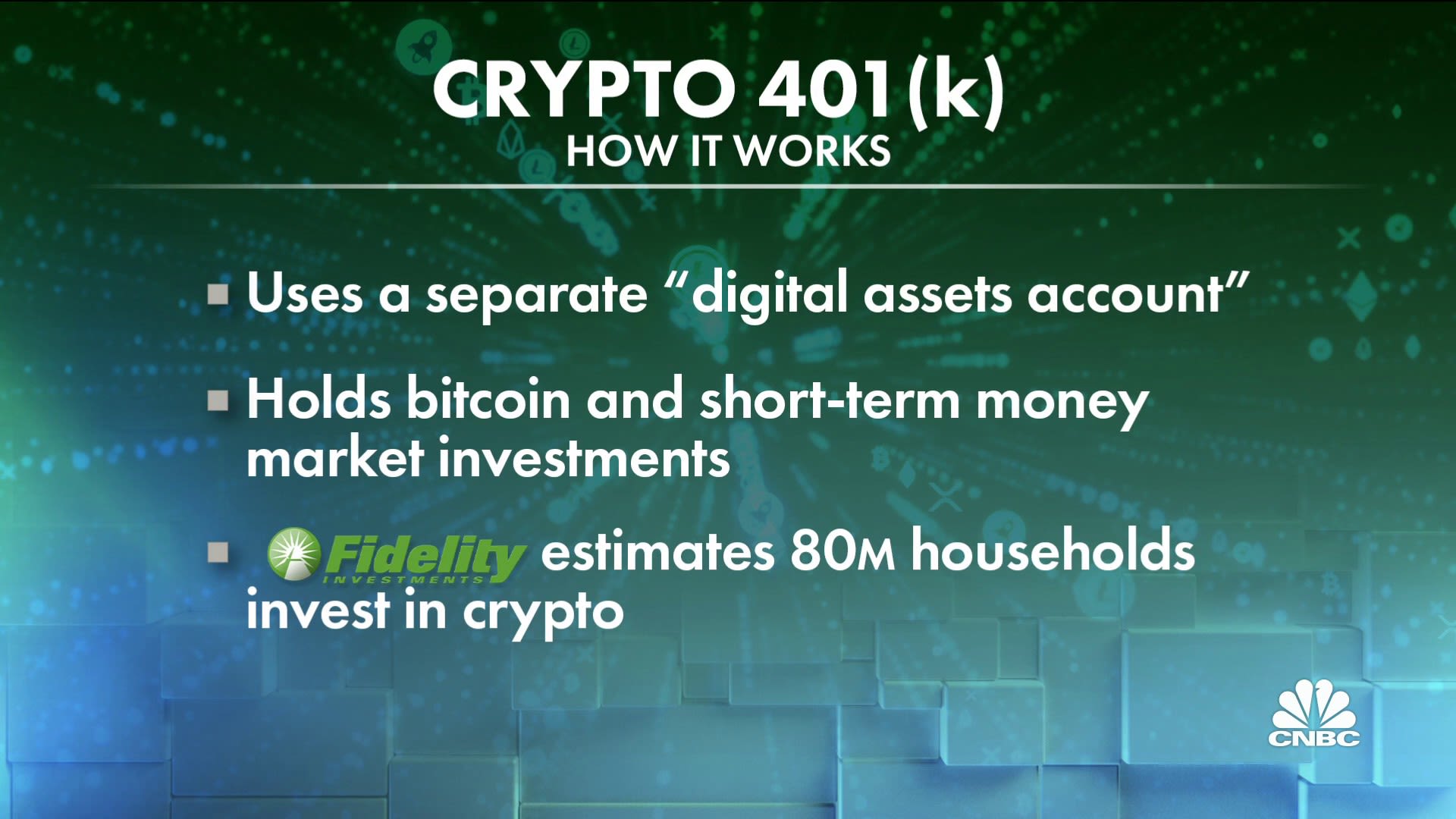

Ad Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity. For some investors this could prove to be a better option than the traditional 401 k where deposits are made on a pre-tax basis but are subject to taxes when the money is withdrawn. Protect Yourself From Inflation.

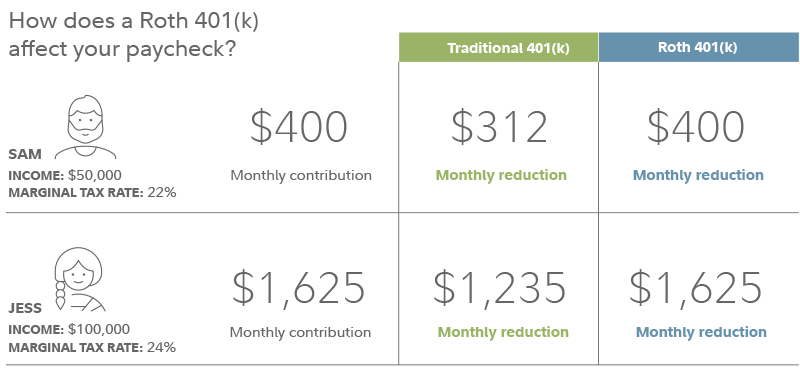

For example if you earn 10000 per month and contribute 10 of it towards a 401k retirement savings. Roth 401 k vs. When you make a pre-tax contribution to your.

Inform your decisions explore your options and find ways to get the most from your 401k 401k Contribution Calculator Contributing to your workplace. 401 k Early Withdrawal Costs Calculator Early 401 k withdrawals will res See more. Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge.

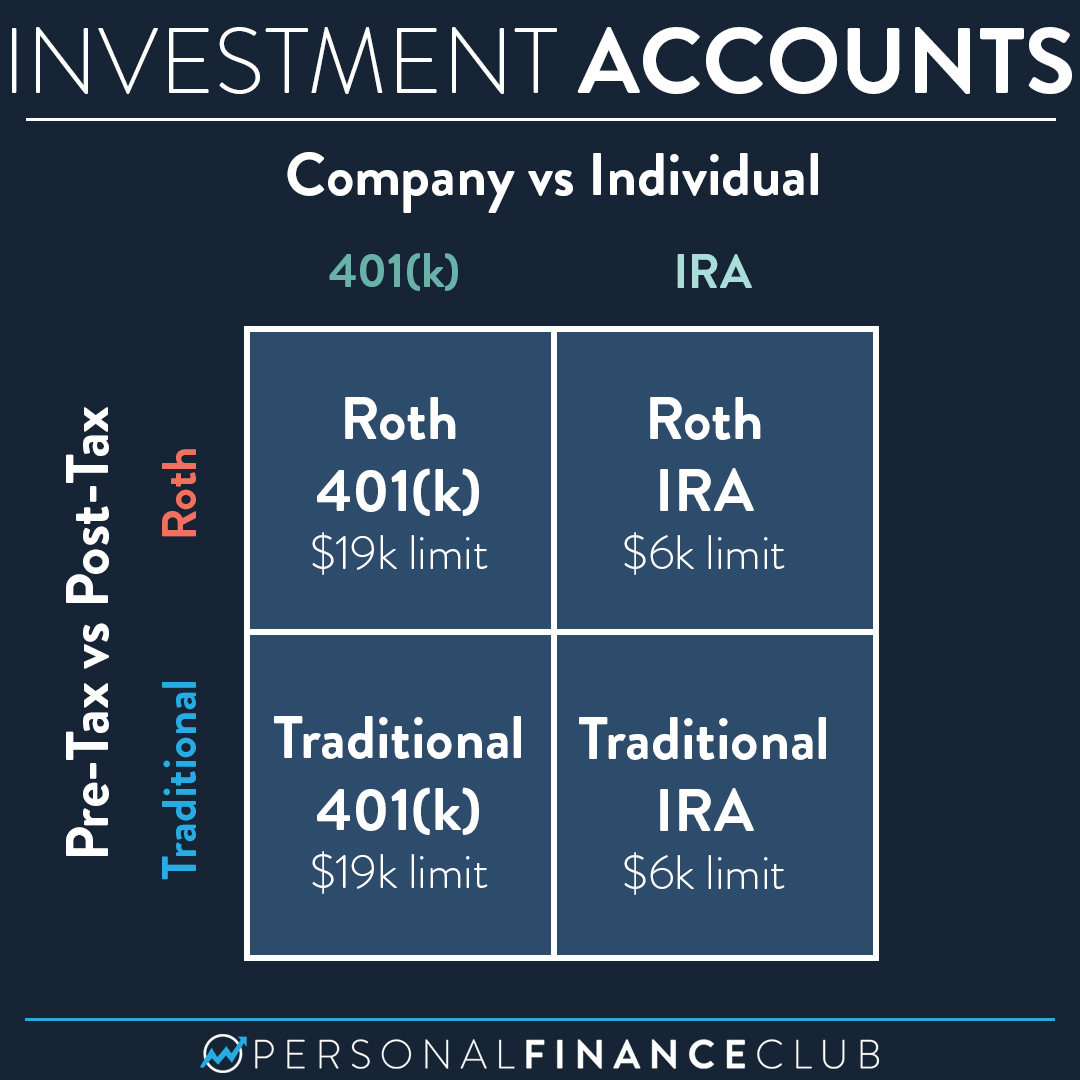

Your 401k plan account might be your best tool for creating a secure retirement. For some investors this could prove to be a better option than the Traditional 401 k contributions where deposits are made on a pre-tax basis but are subject to taxes when the money is. Traditional 401 k Calculator.

For instance a person who makes 50000 a year would put away anywhere. Sign Up in Seconds. The 401 k Calculator can estimate a 401 k balance at retirement as well as distributions in retirement based on income contribution percentage age salary increase and investment.

Salary Your annual gross salary. Evaluate Your Retirement Savings Find Hidden Fees. The Roth 401 k allows you to contribute to your 401 k account on an after.

How frequently you are paid by your. Paychex Retirement Calculator Information The earlier you start contributing to a retirement plan the more the power of compound interest may help you save. This calculator assumes that you make 12 equal contributions throughout the year at the beginning of each month.

Using the calculator In the following boxes youll need to enter. It is mainly intended for use by US. Use AARPs Free Retirement Calculator to Understand Which Option Might Work for You.

The 401 k Calculator can estimate a 401 k balance at retirement as well as distributions in retirement based on income contribution percentage age salary increase and investment return. This calculator is designed to show you how making a pre-tax contribution to your retirement savings plan could affect your take home pay. This rule suggests that a person save 10 to 15 of their pre-tax income per year during their working years.

By making pre-tax contributions you are lowering your current taxable income.

The Ultimate Roth 401 K Guide District Capital Management

Choice Between Pre Tax And Roth 401 K Plans Trickier Than You Think

Making Year 2021 Annual Solo 401k Contributions Pretax Roth And Voluntary After Tax A K A Backdoor My Solo 401k Financial

Roth 401k Roth Vs Traditional 401k Fidelity

Roth 401 K In Plan Roth Conversions Morgan Stanley At Work

Questions You Must Ask Before You Open An Ira Or A 401 K Budgeting Budgeting Money Money Saving Tips

Ira Vs 401 K And Roth Vs Traditional Personal Finance Club

Making Year 2022 Annual Solo 401k Contributions Pretax Roth And Voluntary After Tax A K A Mega Backdoor My Solo 401k Financial

High Earners To Roth 401 K Or Not Greenleaf Trust

How A Diversified 401 K Strategy Can Cut Your Taxes Fisher Investments 401 K Solutions

Imgur The Most Awesome Images On The Internet Flow Chart Chart Of Accounts Finance Advice

2019 Solo 401k Contributions Plus Voluntary After Tax My Solo 401k Financial

After Tax Contributions 2021 Blakely Walters

Complete Retirement Guide To 401 K For Beginners Retirement Savings Plan Investing For Retirement Preparing For Retirement

Mortgage Calculator Mortgage Calculator From Bankrate Com Calculate Payments Wit Mortgage Loan Calculator Mortgage Calculator Mortgage Amortization Calculator

Here S An Example Of How After Tax Contributions Work An Employee Over Age 50 Can Save Up To 62 000 In A Workpl Contribution Retirement Benefits Savings Plan

Corporation Calculating My Solo 401k Contributions For A Corporation My Solo 401k Financial